On behalf of Scan Global Logistics

Global COO & CCO

Advisory

07 May, 2024

A cocktail of continued sustained capacity demand, blank sailing programs and a full-year outlook that offers no positive outlook on the crisis in the Red Sea has sent ocean freight rates on a rapid upward trajectory.

SCFI numbers released on 26 April showed a week-on-week increase across all major trades, with the Asia to Europe trade increasing a whopping USD 658/40´DC from USD 3.942/40´DC to USD 4.600/40´DC.

A similar picture was the case on both the US East and West Coast, with increases of USD 590/40´DC and USD 427/40´DC respectively.

No SCFI numbers were published in week 18 due to the 1 May labour day holidays in China. However, it is expected that this trend will continue in the forthcoming update scheduled for 10 May.

Black clouds all over the horizon

Unless you are a container carrier, it is hard to find optimism from a rate-level perspective, considering there is no expected immediate resolution to some of the key challenges haunting the industry.

The Houthis in Yemen have recently claimed that they intend to expand the geographic area of the attacks; however, as of yet, there have been no attacks that support this claim, and in recent days, only sporadic attacks have been registered.

However, the situation as a whole seems to be in a deadlock, prompting Maersk CEO Vincent Clerc, in connection with the publishing of Q1 results, to state that ‘shipping disruptions caused by Houthi militants' attacks on vessels in the Red Sea were expected to last at least until the end of the year, adding that growth in demand for container shipping had been stronger than forecast’.

Vincent Clerc went on to comment: ‘We have only seen an escalation of the situation in the area and therefore we can see that not only Maersk but all shipping lines have adjusted their networks more or less permanently,’

Turning the attention to the supply and demand situation, Vincent Clerk shared the notion that European importers had now entered a period of restocking, with Maersk enjoying a 9 % increase in volumes during Q1; ‘In Europe, with 9% growth, we believe there is something of a restocking, because there was cautiousness last year in Europe that maybe the macro environment would not be so good, and people had run their stock down. Consumption keeps on holding better than maybe what some of our customers had feared, and now you have a little bit of a restocking going on as we’re moving into the year.’[1]

Peak Season Surcharges & GRI´s across the board

All major container carriers have in recent days announced further Peak Season Surcharges and General Rate Increases (GRI) on both short and long-term contracts, in what from carrier side is described as contingency measures aimed at countering cost effects triggered by Red Sea disruption.

Additionally, it´s also clear that again, and this being reminiscent of rate development during COVID-19 days, we have a situation where long-term contracted rate levels and short-term rate levels are far apart.

In some instances, short- and long-term rates can vary by more than USD 3.000/40´DC on the same trade. As an added comment, carriers are increasingly opting to prioritise and load higher revenue cargo in an attempt, to mitigate bleak financial results posted in Q4 2023 and, to a certain extent, mediocre results in Q1 2024.

Accordingly, our teams will intensify dialogue on priority cargo and offer alternative solutions to ensure timely shipment of your cargo.

We ask for your understanding in the current situation where demand is outweighing available capacity, and as always, our solutions and proposed way forward will be based on individual assessment of each situation.

At the same time, we wish to stress that we acknowledge the cost impact of the current market development and, accordingly, will do our utmost to limit the same while at the same time observing that we can deliver quality solutions.

We expect the current development to continue in the short term until June, with no immediate outlook for the current pressure to ease up.

Airfreight continues to fly high

While ocean freight takes the headlines these days, a somewhat similar situation is apparent in airfreight. Demand continues to be significantly higher than expected on most key trades, amongst others, driven by overflow volumes stemming from Red Sea challenges.

As seen from above illustration, demand has exceeded available supply capacity for a second time in 2024, which, as shown, did not happen once in 2023.

Above said, the situation from a rate level perspective is somewhat more stable vs. ocean freight, with airfreight having already experienced surging levels through February and March.

Our current outlook is that rate levels will remain relatively stable during May with the exception of seasonal impacts. Our priority continues to be keeping you informed. Please do not hesitate to contact your dedicated SGL contact person if you have any questions.

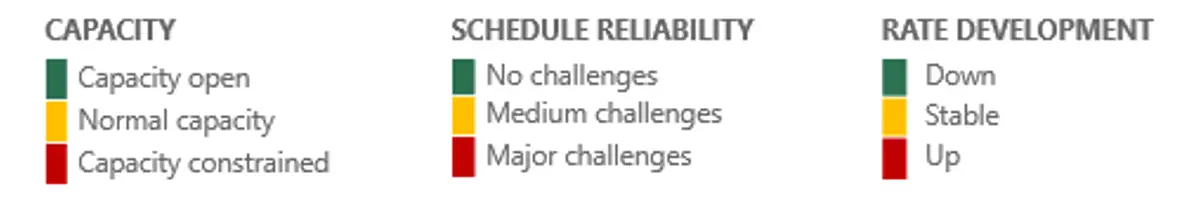

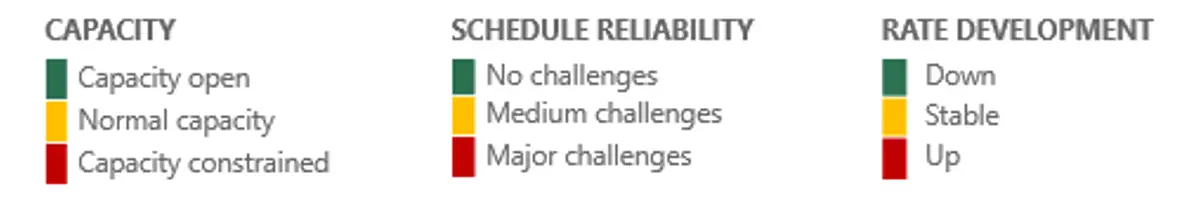

AIRFREIGHT

OCEAN FREIGHT

As always, our teams are working around the clock to keep you duly informed both in terms of potential delays and, not least, in terms of alternative solutions.

All the above information is given to the best of our knowledge and is subject to change.

[1] https://theloadstar.com/shipper-frustration-as-spot-rates-rise-alongside-demand-and-cargo-is-rolled/

On behalf of Scan Global Logistics

Global COO & CCO